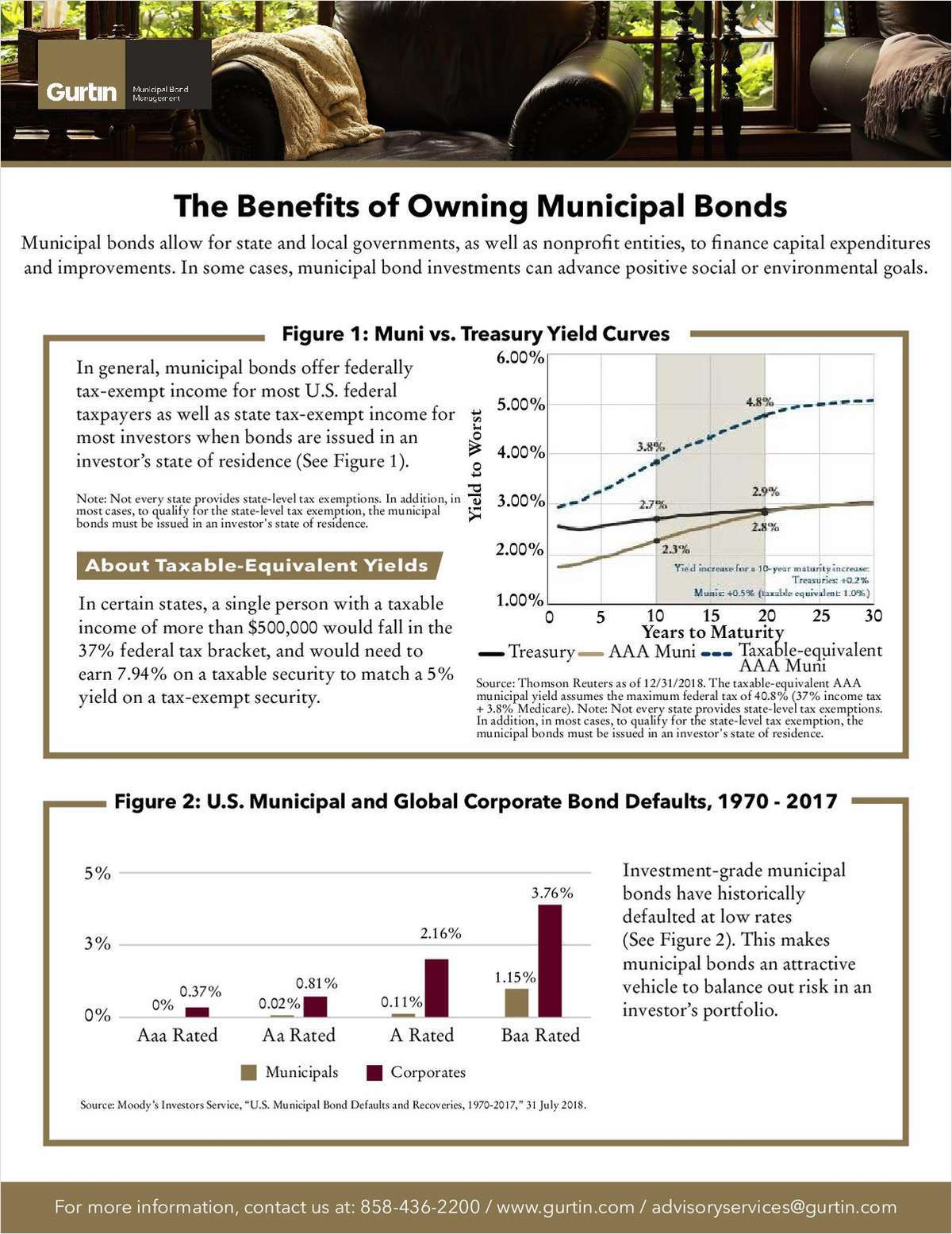

The Benefits of Owning Municipal Bonds

If your clients aren’t already investing in municipal bonds, it might be time to start. Use this tool to show them the potential of this type of investment vehicle.

Municipal bonds have many advantages for investors, including offering federally and/or state tax-exempt income for most taxpayers, being an attractive way to balance out risk in an investor’s overall portfolio, and in some cases, advancing positive social or environmental goals. Unlocking the truth about municipal bonds and understanding key terms and conventions will help you give your clients the information they need to determine if municipal bonds are the right investment choice based on their investment objectives.

Use this tool to help explain the ins and outs of municipal bonds to clients, so they can understand:

- Key benefits of owning municipal bonds

- Definitions of common terms used when discussing municipal bonds

- Municipal bond market norms, including prevalence of bonds with call options and their structural mispricing

- How investors can benefit from access to the municipal bond market through a municipal bond manager, such as Gurtin

If your clients are not already taking advantage of municipal bonds in their portfolio or if they want to learn more, use this tool to demonstrate how munis can help them build the future they want!